Introduction to Blockchain Technology at Cygnus

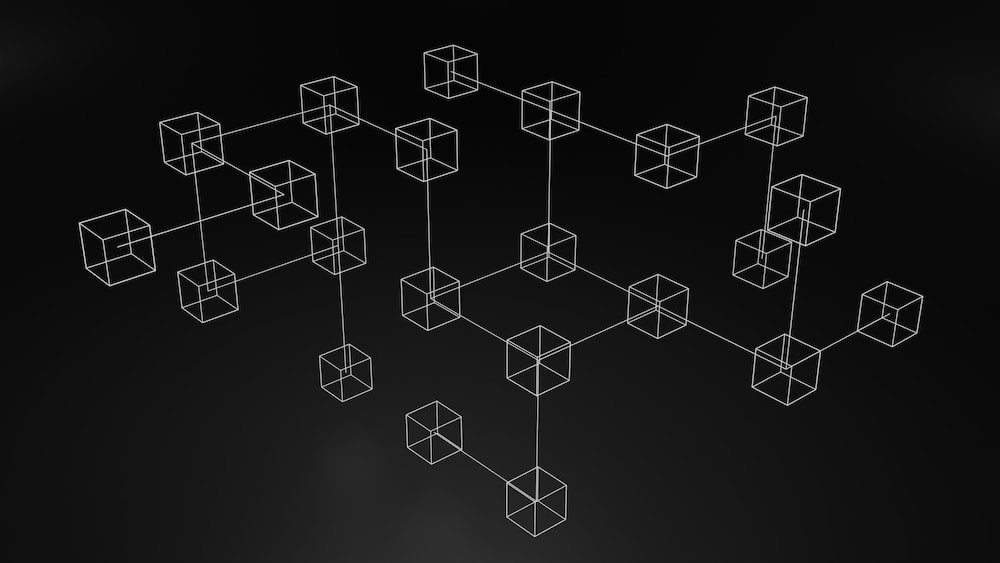

The rise of blockchain technology has led to a paradigm shift in the realm of financial services, initiating groundbreaking advancements in both transactional security and operational efficiency. At the very forefront of these developments is Cygnus Finance, an entity that has woven blockchain into the fabric of its strategic framework.

Blockchain acts as an unalterable ledger that guarantees transparency and strengthens trust in financial interactions. By adopting advanced cryptographic methods, Cygnus Finance employs blockchain to protect client transactions from fraud and data breaches, thereby enhancing the security architecture. As digital assets continue to expand, the decentralized nature of blockchain greatly diminishes the vulnerabilities inherent in traditional financial systems.

Beyond reinforcing security, blockchain optimizes processes, leading to cost savings and accelerated transaction timelines. Contrary to conventional systems that require numerous intermediaries, blockchain technology enables direct peer-to-peer transactions at Cygnus Finance, alleviating delays linked to third-party checks. This swift and effective transaction validation further highlights the firm's dedication to providing state-of-the-art, secure financial services.

In the operations of Cygnus Finance, blockchain not only enhances transactional integrity but also encourages innovation in areas such as cryptocurrency trading. The adoption of blockchain technology is in harmony with the institution's long-range vision, ensuring that its clients stay on the cutting edge of financial evolution while enjoying robust, secure, and efficient service delivery. As blockchain continues to advance, Cygnus Finance is well-positioned to leverage its transformative potential, redefining the future landscape of financial transactions.

How Blockchain Enhances Security in Financial Services

Blockchain technology ushers in a significant transition in the defense structure of financial services, implementing safeguards against hostile threats like fraud and data incursions. The decentralized architecture of blockchain ensures that transactions are unchangeable and transparent, making fraudulent activities vastly more difficult to carry out without exposure. The digital ledger, a fundamental component of blockchain, acts as a repository of truth distributed across countless nodes, rendering it nearly impossible for any nefarious individual to modify information without the network's consensus.

Furthermore, blockchain utilizes advanced cryptographic methods, enveloping transactional data within inviolable encryption frameworks. Each block of data links into a sequence, guaranteeing that any unauthorized attempt to alter information becomes instantly apparent and highlighted for examination. This cryptographic steadfastness not only reinforces financial services but also establishes an unparalleled level of trust among users, who can individually confirm transactions.

Moreover, the smart contract feature inherent to blockchain enables automatic fulfillment of transactional conditions without human intervention, thereby minimizing human error and decreasing the chance for exploitative manipulation. These self-executing contracts can enforce agreements with accuracy, ensuring all involved parties adhere to set terms, further reducing the likelihood of disputes and fraud.

With these sophisticated security mechanisms, blockchain technology provides a sturdy defense system, revolutionizing the domain of financial services by upholding trust and security as central, paving the way for a future where fraudulent and data-breaching actions are severely diminished.

For those involved in Cryptocurrency Trading, Financial Planning, and Investment Strategies, blockchain's advancements not only enhance security but also offer new avenues for innovation and efficiency.

Blockchain’s Role in Cryptocurrency Trading

As the mysterious attraction of cryptocurrency trading captures the global financial landscape, the interdependent relationship between blockchain technology and digital currencies becomes increasingly evident. In an age where clarity and trust are essential to survival, blockchain emerges as the indispensable foundation for ensuring integrity and accountability within trading ecosystems. By its intrinsic design, blockchain functions as a distributed ledger system that makes every transaction unchangeable and publicly confirmable. This trait alleviates the ongoing skepticism surrounding digital monetary exchanges and strengthens the trustworthiness of trade operations.

The core of blockchain in cryptocurrency trading lies in its ability to simplify the intricate processes of fraud detection and prevention. Each transaction, secured with cryptography and linked in chronological order, is resistant to retrospective modifications—an assurance that inspires confidence among traders and institutional investors alike. Consequently, the digital currency landscape transforms into a fortress of reliability, creating an environment supportive of strategic investments free from fraudulent shades.

Moreover, blockchain's transparency ensures that market participants operate on an equal footing, where unrestricted access to transaction records can reveal trading patterns, aiding savvy investors in crafting well-informed investment strategies. This democratization of information reduces the opacity commonly associated with traditional financial planning systems, providing traders with a priceless tapestry of data to navigate unpredictable market dynamics.

In combining these facets, blockchain technology not only elevates the sanctity of cryptocurrency trading but also lays the foundation for a more resilient financial framework. By reinforcing digital currency transactions with unparalleled transparency and unquestionable trust, blockchain not only challenges but also reshapes traditional norms of trade economics.

Future Prospects of Blockchain in Finance

The transformative capacity of blockchain within the financial sector hinges on its capability to boost security, transparency, and efficiency. As blockchain technology evolves, the financial landscape is poised to experience dramatic changes, redefining established paradigms.

One of the most auspicious advancements is the emergence of decentralized finance (DeFi), which empowers peer-to-peer transactions without intermediaries like banks or brokerage firms. By utilizing smart contracts and distributed ledgers, DeFi is dismantling traditional financial frameworks, encouraging unparalleled levels of financial inclusion and democratization. These systems are set to expand beyond niche markets, potentially transforming lending, insurance, and investment sectors.

Furthermore, central banks globally are delving into the concept of Central Bank Digital Currencies (CBDCs). These digital currencies, founded on blockchain technology, could usher in a new era of monetary policy, allowing for real-time transaction monitoring and minimizing inefficiencies in cross-border payments. As governments and financial institutions adapt, businesses must prepare for a digital monetary future where instantaneous settlements could become the standard.

Blockchain’s far-reaching influence will deeply affect asset tokenization, enabling traditional assets like real estate, art, and commodities to be fractionally owned and traded. This transformation could democratize investment opportunities, making asset classes more accessible to a broader section of society while simultaneously increasing liquidity in previously illiquid markets.

Additionally, blockchain’s implications for data security are immense. As cyber threats become more prominent, blockchain offers an unalterable record-keeping system, strengthening defenses against fraud and unauthorized changes. Financial institutions will likely enhance their cybersecurity frameworks with blockchain to protect sensitive customer data and maintain trust.

However, the widespread adoption of blockchain in finance is not free of obstacles. Regulatory complexities and the interoperability of diverse blockchain platforms remain significant challenges. As regulatory bodies examine this digital innovation, a balanced approach is essential to encourage innovation while ensuring adequate oversight.

For businesses like Cygnus Finance, seizing these burgeoning trends requires nimbleness and foresight. Embracing blockchain means not only reconsidering operational strategies but also recalibrating the very nature of financial operations to prosper in an increasingly decentralized ecosystem. As the blockchain story unfolds, its capacity to redefine finance is not merely a possibility but an impending certainty.